Family Travel Insurance Might Save Your 2022 Trip Budget | Travel

Travel disruptions continue to be top-of-head for lots of vacationers, specifically these with households. Booking that prolonged-deferred holiday only to have it drop aside is a real issue. So insuring a trip in opposition to inescapable uncertainties can save people from vacation losses — if finished appropriate.

Worldwide journey is roaring back. For every the International Trade Administration, the amount of U.S. citizens leaving for international destinations in April 2022 was just about 2.5 periods greater than the yr ahead of. Nevertheless traveling overseas even now carries hazard of journey disruption.

In accordance to an August 2021 AAA survey, 31% of U.S. vacationers say they are extra most likely to acquire journey insurance coverage for trips through the conclusion of 2022 for the reason that of the ongoing COVID-19 pandemic.

But what are the finest methods to buy journey insurance for a family members? And, for starters, what is vacation insurance coverage, specifically?

Vacation insurance policies 101

Travel coverage is a bewildering term since it seems like a one factor. In fact, travel insurance policies providers offer you a buffet of insurance options that can implement to your travels. So asking a dilemma these as, “Does journey insurance policies address trip cancellations?” is like asking no matter if dwelling coverage handles earthquakes — some kinds of protection do, and some don’t.

Folks are also reading…

The most prevalent styles of journey insurance coverage protection contain:

- Health care.

- Emergency evacuation and repatriation.

- Journey cancellation and delay.

- “Terminate For Any Purpose.”

Like auto insurance, most journey insurance policy plans will protect multiple prevalent troubles, and you can pick the distinct advantages for your excursion. Your selections will have an affect on the all round price.

A single of the much more typical misconceptions about travel insurance coverage is that it will protect all variations and cancellations. Many vacationers uncovered the real truth the tricky way when the pandemic began, and the charge of their scuttled strategies was not reimbursed by their travel insurance policy procedures. Vacation insurance policy is an umbrella expression, and only sure forms of designs cover alterations and cancellations brought about by unforeseen gatherings.

Here’s the gist: If you’re looking for vacation insurance policy that handles adjustments brought on by COVID-19 disease and border closure, lookup for suppliers that present it particularly. It’s not normally clever to take the insurance policies strategy presented during checkout when you obtain vacation by way of an airline or resort web page.

Does journey insurance policy deal with loved ones users?

Confident, you could get reimbursed for your journey if you come down with COVID-19 the day prior to you’re established to depart. But what if your toddler does?

For the most section, travel insurance policy protection will offer the possibility to consist of relatives users. Some designs will involve children 17 and younger quickly when they are touring with a father or mother. Some others will require that you incorporate just about every relatives member independently to the strategy.

This is an important distinction, primarily when evaluating expenses amongst distinct travel insurance policies.

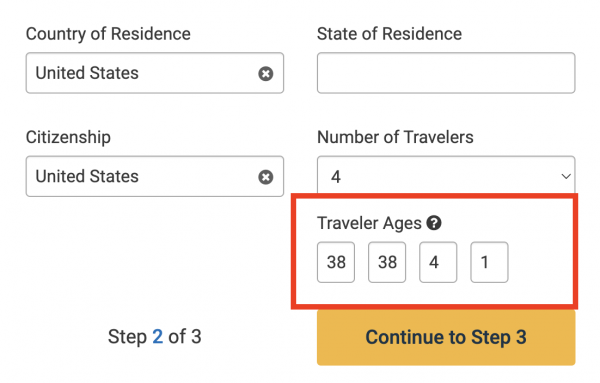

Utilizing a comparison instrument can aid, specially if you do not enjoy wading through the wonderful print. You can enter your loved ones members’ ages and the tool will automatically aspect individuals into its selling price comparisons.

An insurance plan comparison tool like Squaremouth (a NerdWallet associate) can aid you find a adequate policy. (Screenshot courtesy of Sam Kemmis)

Of training course, you can generally double-look at the terms and disorders to make guaranteed each individual loved ones member is included sufficiently. But working with a comparison device in this way can help you save a big headache.

Think about other flexible solutions

The pandemic has shifted the globe of vacation insurance policies to focus extra on flexibility. But it’s experienced the very same influence throughout the travel globe.

Airways and resorts now generally offer you a lot more versatile booking choices. With the noteworthy exception of essential overall economy airfares, which normally can not be modified or canceled, airline tickets are now significantly far more versatile than they had been two many years ago.

It is also the circumstance that various high quality credit score cards incorporate travel insurance coverage as a developed-in benefit for any bookings produced with people cards (nevertheless coverage policies change).

What does this indicate for traveling family members? It may make perception to make flexible bookings alternatively than get relatives vacation insurance that covers adjustments and cancellations. The other benefits of vacation insurance policies, these types of as medical protection, could possibly nevertheless be a wise shift. But make guaranteed you’re not acquiring cancellation coverage for a trip that is previously particularly versatile.

The bottom line

Traveling with an full spouse and children can be a big cost. And like any cost, it can be sensible to insure it.

Most vacation insurance plan policies will address families, either automatically or for an more cost. The best way to look at plans is to use a journey insurance plan comparison instrument, enter your relatives customers and trip facts, and opt for the system that tends to make sense for you.

Remember: Not all ideas address the exact thing. If you are worried about cancellations prompted by COVID-19, make positive to search for that protection specifically. And consider other versatile booking options past insurance coverage when producing plans.

The post Household Travel Insurance coverage May Help save Your 2022 Trip Price range originally appeared on NerdWallet.